Liquidity mining pools have emerged as a cornerstone of decentralized finance (DeFi), offering participants the opportunity to provide liquidity to various protocols in exchange for lucrative rewards. Understanding the intricacies of liquidity provision and yield farming is essential for anyone looking to navigate the rapidly evolving DeFi landscape. In this comprehensive guide, we delve into the fundamentals of liquidity mining pools, explore the benefits and risks associated with participation, and provide valuable insights on selecting the right pools for your investment strategy. Whether you are a seasoned DeFi enthusiast or a newcomer to the space, this article aims to equip you with the knowledge and tools necessary to make informed decisions and maximize returns in the realm of DeFi liquidity mining.

Introduction to Liquidity Mining Pools in DeFi

Definition and Evolution of Liquidity Mining in DeFi

Liquidity mining pools in decentralized finance (DeFi) involve users providing liquidity to decentralized exchanges in exchange for rewards in the form of tokens. This innovative concept has rapidly gained popularity in the crypto space, evolving from a novel idea to a fundamental mechanism for incentivizing liquidity provision in DeFi protocols.

Understanding Liquidity Provision and Yield Farming

Key Concepts: Liquidity Provision vs Yield Farming

In liquidity provision, users add funds to a liquidity pool to facilitate trading on decentralized exchanges, earning a share of the trading fees. Yield farming, on the other hand, involves users staking their assets in DeFi protocols to earn additional rewards, often in the form of governance tokens or protocol-specific tokens.

Mechanisms of Yield Generation in DeFi

Yield generation in DeFi can be achieved through various mechanisms, including liquidity mining, staking, lending, and other yield optimization strategies. These mechanisms offer users the opportunity to earn passive income on their crypto assets by actively participating in DeFi platforms.

Benefits and Risks of Participating in Liquidity Mining Pools

Benefits of Liquidity Mining Pools

Participating in liquidity mining pools can offer users high APYs (Annual Percentage Yields), exposure to new tokens, and opportunities to actively engage with DeFi projects. Additionally, it can diversify one’s crypto portfolio and provide a source of passive income in the volatile crypto market.

Risks and Challenges to Consider

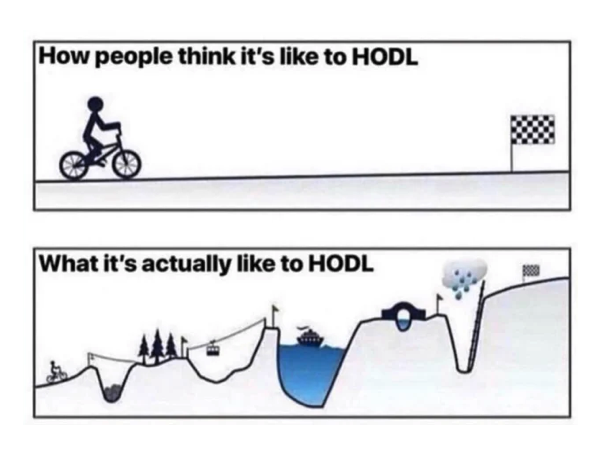

Despite the lucrative rewards, participants in liquidity mining pools also face risks such as impermanent loss, smart contract vulnerabilities, and market volatility. It’s important for users to carefully assess these risks before committing their assets to any DeFi protocol.

Selecting the Right Liquidity Mining Pool for Your Investment Strategy

Factors to Consider When Choosing a Liquidity Mining Pool

When selecting a liquidity mining pool, consider factors such as the project’s credibility, tokenomics, APY, lock-up periods, and overall market conditions. Conduct thorough research and due diligence to minimize risks and maximize potential rewards.

Diversification Strategies in Pool Selection

Diversifying across multiple liquidity mining pools can help mitigate risks and optimize returns. By spreading investments across different projects and protocols, users can protect themselves from potential losses in any single pool and capture opportunities in a variety of DeFi ecosystems.

Strategies for Maximizing Returns in DeFi Liquidity Mining

Optimizing Liquidity Allocation and Pool Selection

When it comes to making the most out of your liquidity mining endeavors, it’s crucial to carefully consider how you allocate your assets across different pools. Diversifying your liquidity can help spread risk and maximize potential returns. Additionally, choosing the right pools to participate in is key. Look for pools with high APYs, strong token fundamentals, and low impermanent loss risks.

Advanced Yield Optimization Techniques

For those looking to take their DeFi game to the next level, exploring advanced yield optimization techniques can be a game-changer. Strategies such as yield farming, leveraging flash loans, or utilizing arbitrage opportunities can help boost your overall returns. Keep in mind that these techniques often come with increased risks, so it’s essential to conduct thorough research and understand the potential downsides.

Case Studies: Successful Liquidity Mining Pool Experiences

Real-world Examples of Profitable Liquidity Mining Strategies

Delving into real-world case studies of successful liquidity mining experiences can provide valuable insights and inspiration for your own strategies. By studying how others have achieved profitability in liquidity mining pools, you can learn valuable lessons and apply them to your own investment decisions.

Lessons Learned from Notable Liquidity Mining Pool Case Studies

Examining both successful and unsuccessful liquidity mining pool case studies can offer important lessons for investors. Understanding the factors that contributed to success or failure in these scenarios can help you navigate your own liquidity mining journey more effectively. Whether it’s identifying key patterns, avoiding common pitfalls, or adapting strategies based on market conditions, there’s much to be gained from analyzing past experiences.

Regulatory Considerations and Future Trends in DeFi Liquidity Mining

Current Regulatory Landscape for Liquidity Mining

As the DeFi space continues to evolve, regulatory considerations around liquidity mining are gaining more attention. Understanding the current regulatory landscape and compliance requirements is essential for participants in liquidity mining pools. Keep abreast of any regulatory developments and ensure your activities align with legal guidelines to minimize potential risks.

Emerging Trends and Innovations in DeFi Liquidity Mining

Looking ahead, the future of liquidity mining in DeFi promises exciting developments and innovations. Keep an eye out for emerging trends such as algorithmic stablecoins, decentralized derivatives, and cross-chain interoperability, which are set to reshape the DeFi landscape. Staying informed about these advancements can help you position yourself strategically in the evolving world of DeFi liquidity mining.In conclusion, liquidity mining pools represent a dynamic and potentially rewarding avenue for engaging with DeFi protocols. By carefully weighing the benefits, risks, and strategies outlined in this guide, participants can navigate the complexities of liquidity provision and yield farming with confidence. As the DeFi ecosystem continues to evolve, staying informed about regulatory considerations and emerging trends will be crucial for maximizing returns and staying ahead in this rapidly changing landscape. Embracing the opportunities presented by liquidity mining pools while remaining mindful of the associated risks can position investors for success in the exciting world of decentralized finance.